All Categories

Featured

Table of Contents

These functions can differ from company-to-company, so be sure to discover your annuity's death benefit features. A MYGA can indicate reduced taxes than a CD.

At the really the very least, you pay taxes later on, instead than sooner. Not only that, but the intensifying interest will be based on an amount that has actually not already been tired.

Your recipients can pick either to obtain the payment in a round figure, or in a series of revenue repayments. 3. Commonly, when somebody passes away, also if he left a will, a court decides that obtains what from the estate as often loved ones will say about what the will certainly ways.

With a multi-year fixed annuity, the proprietor has actually clearly assigned a recipient, so no probate is needed. If you contribute to an Individual retirement account or a 401(k) plan, you obtain tax obligation deferment on the revenues, just like a MYGA.

Pricing Annuities

Those items already offer tax deferment. MYGAs are wonderful for people that want to stay clear of the risks of market changes, and desire a taken care of return and tax deferment.

The insurance firm invests it, typically in high top quality long-term bonds, to fund your future settlements under the annuity. Remember, the insurance company is counting not just on your private settlement to money your annuity.

These commissions are constructed into the acquisition rate, so there are no concealed costs in the MYGA contract. Postponed annuities do not bill costs of any type of kind, or sales costs either. Certain. In the current atmosphere of reduced rates of interest, some MYGA financiers construct "ladders." That indicates acquiring numerous annuities with staggered terms.

What Is Annuity Benefits

For instance, if you opened MYGAs of 3-, 4-, 5- and 6-year terms, you would certainly have an account growing each year after 3 years. At the end of the term, your money might be taken out or put into a brand-new annuity-- with good luck, at a higher rate. You can also make use of MYGAs in ladders with fixed-indexed annuities, an approach that looks for to make best use of yield while likewise shielding principal

As you contrast and comparison images provided by various insurance policy companies, take into factor to consider each of the locations listed over when making your final decision. Comprehending agreement terms as well as each annuity's benefits and drawbacks will certainly enable you to make the ideal decision for your monetary scenario. Believe thoroughly about the term.

What Is A Typical Annuity Rate

If passion prices have risen, you may desire to secure them in for a longer term. During this time, you can get all of your money back.

The firm you purchase your multi-year ensured annuity through accepts pay you a fixed rates of interest on your costs amount for your chosen amount of time. You'll get interest attributed on a routine basis, and at the end of the term, you either can renew your annuity at an upgraded price, leave the cash at a taken care of account rate, choose a settlement choice, or withdraw your funds.

Fixed Annuity Plans

Considering that a MYGA supplies a set passion price that's assured for the contract's term, it can give you with a predictable return. With rates that are set by agreement for a particular number of years, MYGAs aren't subject to market variations like other investments.

Limited liquidity. Annuities typically have charges for very early withdrawal or surrender, which can restrict your ability to access your money without charges. Reduced returns than other financial investments. MYGAs might have reduced returns than stocks or common funds, which might have higher returns over the long term. Fees and expenses. Annuities normally have surrender fees and administrative prices.

MVA is an adjustmenteither positive or negativeto the gathered worth if you make a partial abandonment over the free amount or totally surrender your contract throughout the abandonment charge duration. Rising cost of living risk. Because MYGAs supply a set rate of return, they might not equal rising cost of living gradually. Not guaranteed by FDIC.

Can I Cancel My Annuity

:max_bytes(150000):strip_icc()/annuity-ladder.asp-final-bb1e6602acd2498ead56e5f8bcb458c3.png)

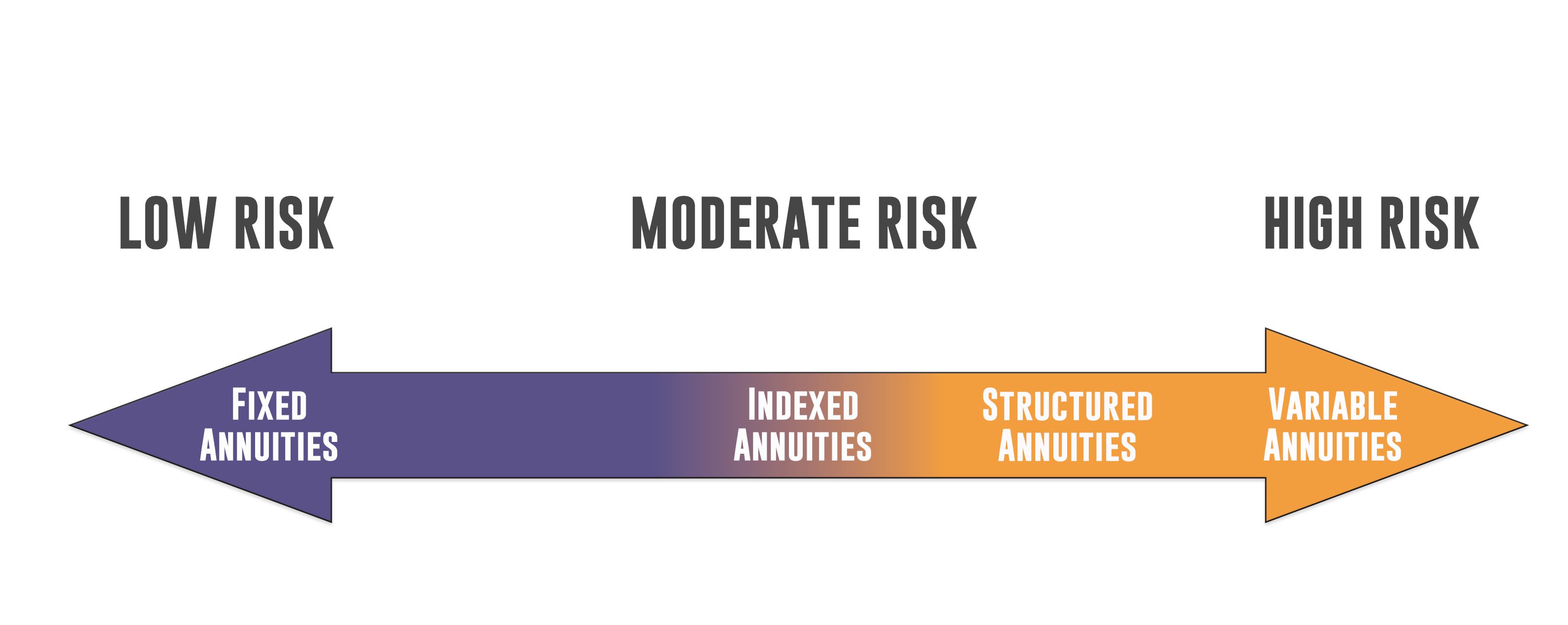

It's crucial to veterinarian the toughness and stability of the company you pick. Consider reports from A.M. Best, Fitch, Moody's or Requirement & Poor's. MYGA prices can transform usually based on the economy, yet they're typically greater than what you would certainly gain on a savings account. The 4 kinds of annuities: Which is right for you? Required a refresher course on the four fundamental types of annuities? Find out more how annuities can ensure an earnings in retired life that you can't outlast.

If your MYGA has market price modification provision and you make a withdrawal before the term mores than, the company can adjust the MYGA's abandonment worth based upon modifications in rate of interest - annuity payment sell. If rates have raised since you acquired the annuity, your surrender worth might lower to represent the greater rates of interest setting

Nonetheless, annuities with an ROP arrangement typically have lower guaranteed rate of interest to balance out the business's possible threat of needing to return the premium. Not all MYGAs have an MVA or an ROP. Terms and conditions rely on the firm and the contract. At the end of the MYGA period you have actually picked, you have 3 options: If having actually an assured rate of interest for a set variety of years still aligns with your monetary approach, you simply can restore for another MYGA term, either the same or a various one (if available).

With some MYGAs, if you're not sure what to do with the cash at the term's end, you don't have to do anything. The collected value of your MYGA will relocate into a dealt with account with a renewable one-year interest rate established by the company - cost to buy an annuity. You can leave it there till you select your following step

While both deal assured rates of return, MYGAs usually supply a higher rates of interest than CDs. MYGAs expand tax obligation deferred while CDs are exhausted as earnings every year. Annuities expand tax obligation deferred, so you don't owe earnings tax on the earnings up until you withdraw them. This permits your earnings to intensify over the regard to your MYGA.

This reduces the potential for CDs to take advantage of lasting compound passion. Both MYGAs and CDs usually have very early withdrawal penalties that might impact temporary liquidity. With MYGAs, abandonment costs might use, depending upon the sort of MYGA you pick. You may not only lose rate of interest, however likewise principalthe money you initially contributed to the MYGA.

Guaranteed Principal Annuity

This suggests you may weary however not the major quantity added to the CD.Their traditional nature often charms a lot more to people who are approaching or currently in retirement. But they may not be right for every person. A may be right for you if you desire to: Make the most of an assured rate and lock it in for a time period.

Gain from tax-deferred incomes development. Have the alternative to choose a negotiation choice for an ensured stream of revenue that can last as long as you live. Just like any type of cost savings lorry, it is very important to very carefully examine the conditions of the product and seek advice from with to identify if it's a wise choice for achieving your individual needs and objectives.

1All assurances including the survivor benefit repayments are dependent upon the cases paying ability of the issuing business and do not put on the financial investment performance of the hidden funds in the variable annuity. Possessions in the hidden funds go through market risks and might vary in value. Variable annuities and their hidden variable financial investment alternatives are marketed by prospectus only.

30 Year Annuity Interest Rate

Please read it before you spend or send cash. 3 Present tax legislation is subject to analysis and legal change.

Entities or persons distributing this information are not accredited to provide tax or legal suggestions. Individuals are motivated to look for specific advice from their personal tax obligation or lawful counsel. 4 , Exactly How Much Do Annuities Pay? 2023This material is planned for general public use. By supplying this content, The Guardian Life Insurance Policy Business of America, The Guardian Insurance & Annuity Company, Inc .

Table of Contents

Latest Posts

Breaking Down Fixed Vs Variable Annuities A Comprehensive Guide to Investment Choices What Is Variable Annuity Vs Fixed Annuity? Benefits of Annuities Variable Vs Fixed Why Choosing the Right Financia

Understanding Immediate Fixed Annuity Vs Variable Annuity Key Insights on Annuities Fixed Vs Variable What Is Variable Vs Fixed Annuities? Features of Fixed Annuity Vs Variable Annuity Why Fixed Annui

Exploring Variable Vs Fixed Annuity Key Insights on Your Financial Future What Is the Best Retirement Option? Advantages and Disadvantages of Pros And Cons Of Fixed Annuity And Variable Annuity Why Fi

More

Latest Posts